#

Tokenomics (W.I.P.)

#

Introduction

#

Overview

#

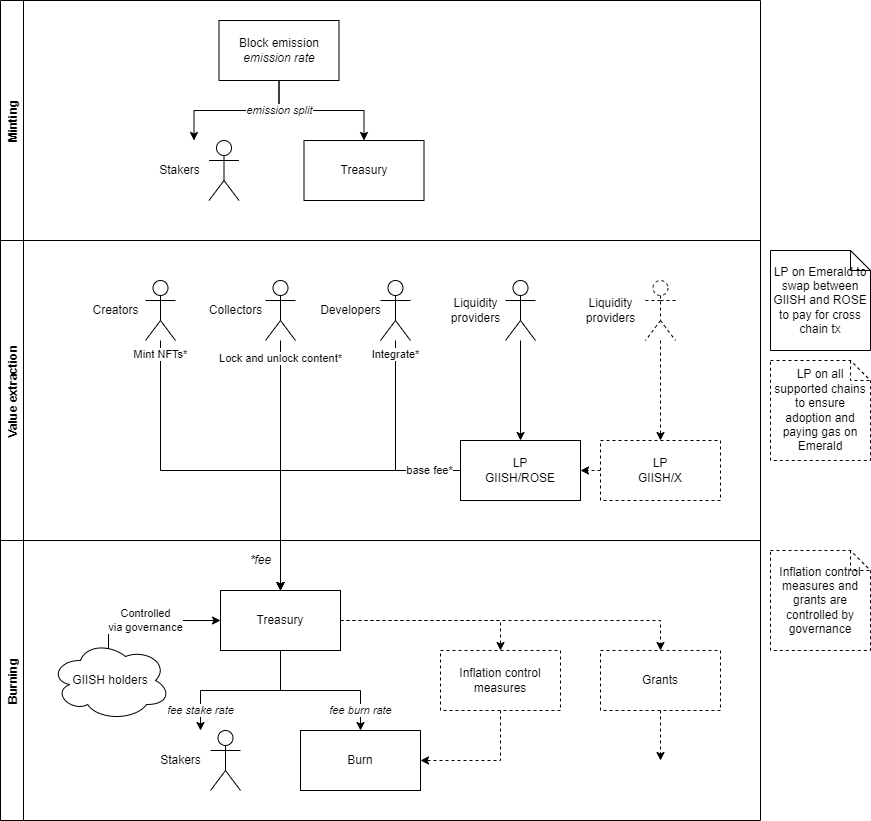

Model

Cursive texts on connections are model parameters controlled by governance. A summary is provided below.

#

Actors and actions

#

Governance and voting

Geniish protocol will be controlled by the community and its users. Everybody holding GIISH can vote on proposals created by the protocol team and partake in the governing of the network. Generally, all parameters used within the protocol can be changed by proposals.

During the development and adoption of the protocol, the team holds the right to proposals and a final decision. This is by controlling the voting rights of the reserve. Which holds 51% of the initial supply. After around one year this will be transferred to the treasury and proposals are open for everyone for a fee.

The treasury is only controlled by governance. Parts of fees and other profits generated by the protocol are transferred to the treasury. GNIISH holders can vote on what happens to these assets.

Scenarios for withdrawing are further development, giveaways and buyback GIISH for burning.

#

Token Roadmap

#

Initial mint usage

Geniish will initially mint 250'000'000 GIISH, which is around 25% of the planned total supply after five years. This will be used to fund and kickstart the development and adoption of the protocol.

*During development, the reserve is owned by the protocol team to ensure controller over governance. After the vesting period, all tokens will be transferred to the treasury.